What Can I Expect to Pay for a Payday Loan?

Payday loans normally cost more than other types of personal loans, especially if you take longer than two weeks to pay them off. But, if you pay them off on time the rates are much more affordable.

Average Payday Loan Fees and Rates

Payday lenders typically loan from $100 to $1000. The lenders normally charge a finance charge, fee or interest rate of 15 to 30 percent for each hundred dollars borrowed. So you pay $15 to $30 per hundred dollars for your loan as long as you pay the loan back on time. If you have to extend beyond the initial period (usually 14 days), you will have to pay the finance charge again after the extension period.

For example, if you borrow $300 with a 20% interest rate or finance charge, you will pay back the loan amount of $300 plus the 20% finance charge, which is $60 at the end of the two week period. If you extend the payoff to four weeks you end up paying the loan amount plus $120 ($60 in interest over two periods). As you can see, the longer you wait to payback the loan the more money you end up paying back. That’s why it is important that you pay back the loan on time.

How to Compare Lender Fees and Rates

The best way to compare rates and fees from different lenders is to figure out the total amount above the loan amount you will owe at the end of the initial 14-day pay period. The lender may present their charges as a fee, interest rate or finance charge, but the bottom line is if you will pay back $125 if you borrow $100 you have a 25% or $25 cost for the loan. So read the documents carefully to find out exactly what you will owe at the end of the loan. You should look for the lender who charges you the least overall amount for the loan. Most lenders will spell out their fees and rates clearly, but if you have questions ask for clarification before you accept the loan.

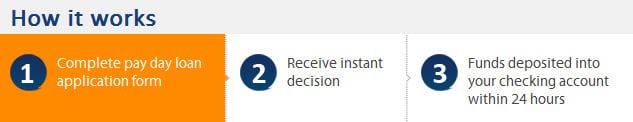

Paydayloansonline.org has assembled a large network of payday lenders. This creates the ideal platform where lenders compete for your business, which makes it easy for you to receive multiple loan offers so you can choose the best fees and rates. Plus, if you are not completely satisfied with the rates and terms of one lender you can always move on to another.